The De Minimis Exemption Ends for China and Hong Kong on May 2

What Is the De Minimis Exemption and Why Does It Matter?

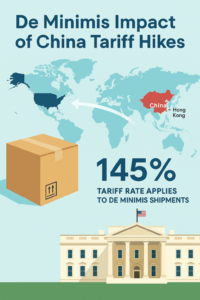

The De Minimis Exemption allows imported goods valued under $800 to enter the U.S. duty-free. For years, it’s helped e-commerce sellers ship low-cost products from overseas directly to American customers without paying tariffs. This created a major advantage for companies sourcing from China and Hong Kong.

New Rules Will Disrupt Direct-to-Consumer Supply Chains

Starting May 2, products from China and Hong Kong will no longer qualify for this exemption. These goods will now be subject to full tariffs, significantly impacting brands that depend on cheap cross-border shipping. The change will especially affect fast-fashion giants and discount marketplaces that built their pricing models around this loophole.

Postal Imports Face Special Rules, But It’s Still Costly

Why Are Postal Shipments Treated Differently?

While express shipments from China and Hong Kong will lose the De Minimis Exemption outright, postal imports are getting phased into the new duty structure. Instead of paying full tariffs right away, these packages will be charged either 120% in duties or a $100 flat fee — increasing to $200 on June 1.

Postal Carriers Are Already Suspending U.S.-Bound Shipments

Unlike express couriers, postal systems aren’t equipped to handle detailed customs processing. Hong Kong Post has already suspended surface and airmail to the U.S., citing their inability to collect and report tariffs. As postal networks collapse under new pressure, brands may be forced to find alternate delivery methods immediately.

How Tariffs Will Impact Product Pricing

Expect a Surge in Sales Followed by Price Increases

Leading up to May 2, many brands will push promotions to move as much product into the U.S. as possible while the De Minimis Exemption still applies. This means consumers might see discounts now — but should prepare for price hikes in the weeks that follow.

Brands Must Educate Customers About New Costs

Companies like Shein and Temu will need to either eat the cost of tariffs or pass them onto consumers. Experts advise transparent communication — whether it’s breaking down duties at checkout or incorporating them into final prices. Shoppers may not like it, but honesty about why prices are changing can preserve trust.

How Supply Chains Can Adapt to De Minimis Changes

Fulfillment May Shift Back to the United States

To reduce reliance on the De Minimis Exemption, many brands are now reshoring their logistics. Fulfillment centers in Mexico and Canada, once used to maintain exemption eligibility, may be replaced by U.S.-based operations to avoid risk as policies tighten.

Strategic Imports and Legal Support Can Lower Costs

For companies that still rely on overseas suppliers, bringing in inventory in bulk and using experienced customs brokers can cut expenses. Grouping Chinese-origin items into single manifests helps lower brokerage fees — even if tariffs still apply — while separating products by country of origin can streamline duties.

Will the De Minimis Exemption Disappear Entirely?

A Full Global Phase-Out Could Be Coming

While the May 2 change only applies to China and Hong Kong, the White House has signaled it plans to eliminate the De Minimis Exemption for other countries as well. An executive order outlines a future where duty-free thresholds may be replaced with full tariffs once systems can support enforcement.

A Lower Universal Threshold May Replace The De Minimis Exemption

Some experts believe the exemption won’t vanish entirely, but will evolve. A lower, globally standardized threshold may be implemented instead of the current $800 cap. This could simplify enforcement while reducing the volume of tariff-free imports.